Best Practices

Overcoming the Unfair Billing Stack

As we continue to deploy Maple to several customers, we've further validated the need for a state-of-the-art billing platform that solves for needs for modern SaaS companies from engineering infrastructure all the way to sales and revenue management. Most traditional billing platforms tend to solve for the needs of a single stakeholder or a single sales motion, but the reality is that with today's competitive landscape, companies are force to iterate on all these dimensions quickly and often simultaneously. And billing systems need to scale with these iterations.

The Modern Billing Stack

Billing systems have had to undergo tremendous evolution in the past few years. It is no longer about just issuing recurring invoices and collecting payments anymore, it is about developing a key business strategy that lends itself to growth levers in the future. This has become even more pronounced with the emergence of several new business models around AI and SaaS infrastructure.

With modern billing needs in mind, today's billing stack needs to support the following capabilities

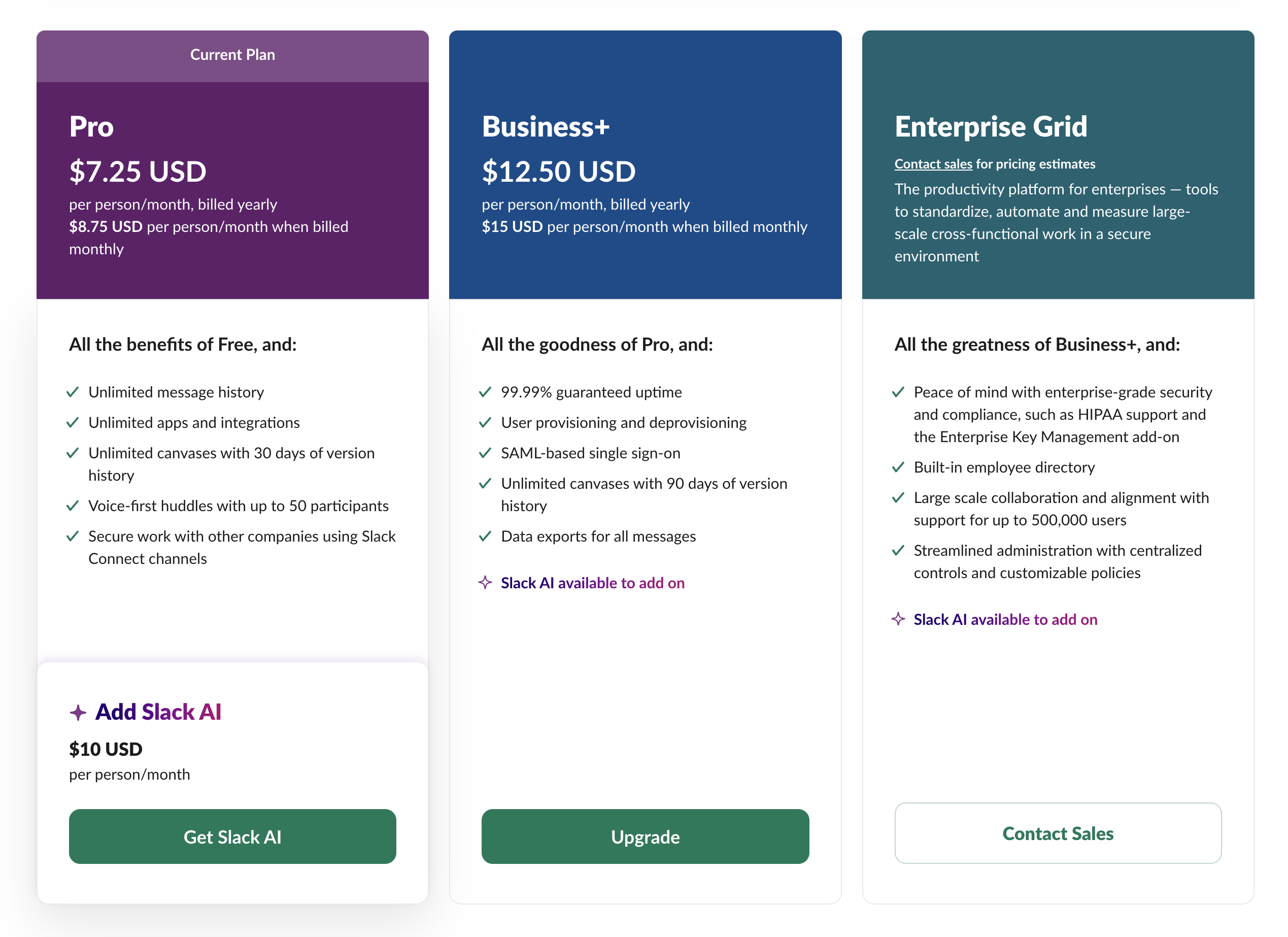

- Subscriptions & Invoicing: Invoices typically include the service or the product purchased, payment terms, the price, and applicable taxes and fees. You can use invoices to ensure payment, track sales, and provide accounting documentation. Subscriptions are a recurring, periodic payment method and by far the most common pricing strategy for SaaS tools.

- Quotes & Contracts: Contracts are the legally binding agreements between a customer and the vendor for the use of software. SaaS quotes provide all the details of pricing to the customer. It goes beyond the numbers to package the pricing into an experience.

- Feature Entitlements: The set of features or services that customers feel they are entitled to receive based on the price. Every customer evaluates whether the features of a product justify the cost, and meeting those expectations is pivotal for retention and customer satisfaction.

- Seats Tracking: A common SaaS pricing model is the "pay-per-seat" pricing model. In this model, you charge customers based on the number of users they have on their accounts. This means you also need to keep track of the number of seats for every user along with proration to ensure accurate pricing.

- Credits and Usage Tracking: Another common SaaS pricing model is usage-based pricing. This requires you to track the use of the application/service per user, per application, or server. Credit-based pricing is a model that SaaS companies generally use for products that do not require continuous use. You could buy the credits through a one-time transaction or a subscription and then redeem them.

- Payments Processing: This is a critical component of the billing stack as it enables you to accept electronic payments securely and efficiently. This can help you enhance the value proposition of your software, improve user experience, and streamline revenue generation.

- Revenue Metrics: Tracking money generated through product or service sales through revenue. However, it is not as simple as just computing price times quantity, there are a couple of metrics to keep in mind based on your company's operating model. You also need to be able to ensure consistent and accurate reporting of financial performance through different lenses such as deferred revenue, aged invoices and complete revenue recognition. The timing and method of these metrics is crucial because it directly impacts financial position, reported profitability, and cash flow.

Why are Traditional Billing Systems Unfair and Broken?

Given how billing has evolved from just sending out invoices, traditional billing systems were a better fit for the subscription economy. At first, subscriptions were based on the number of seats, users, or licenses, packaged in annual or monthly contracts. As SaaS companies continued to evolve, so did pricing strategies.

Let us look at some reasons why traditional billing systems are not built for SaaS business today.

Revenue Loss Pile Up

It used to take months or even years to buy new software. The days of tech executives sitting down with field sales reps are long gone. Today, more and more buyers are opting for self-education because they expect value before investing their time or money on products. Product-led growth is all the rage right now.

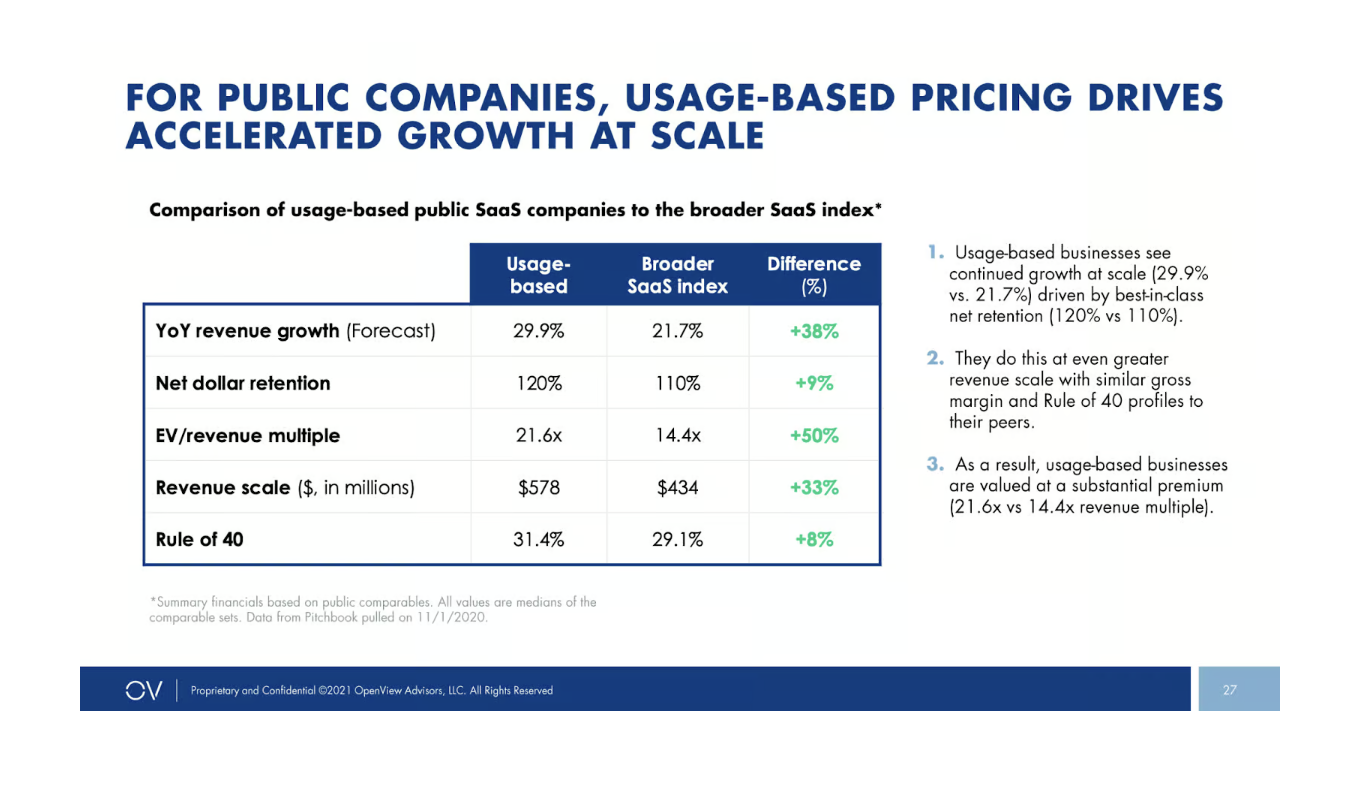

Seat-based subscriptions gave way to pricing based on other value-aligned metrics (like sites and devices). With competitive products picking up steam, companies are getting customer-friendly in their pricing strategies by adopting usage-based pricing as a "pay-as-you-go" model. This move has further accelerated with the rise of AI and SaaS infrastructure companies.

Companies adopting the usage-based pricing model are clearly growing their top line revenue, but can the same be said for their costs?

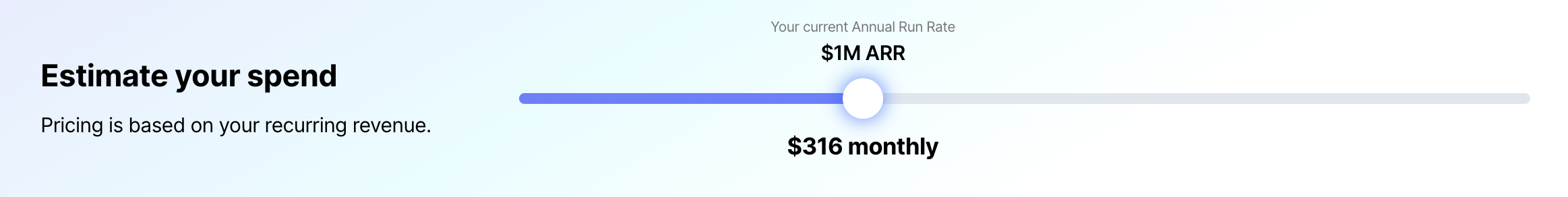

Traditional billing systems charge a percentage of your revenue, so if your ARR doubles, so does the cost of your billing solution. It does not matter if you only added a few customers to achieve that revenue growth, the cost is going to keep piling up regardless.

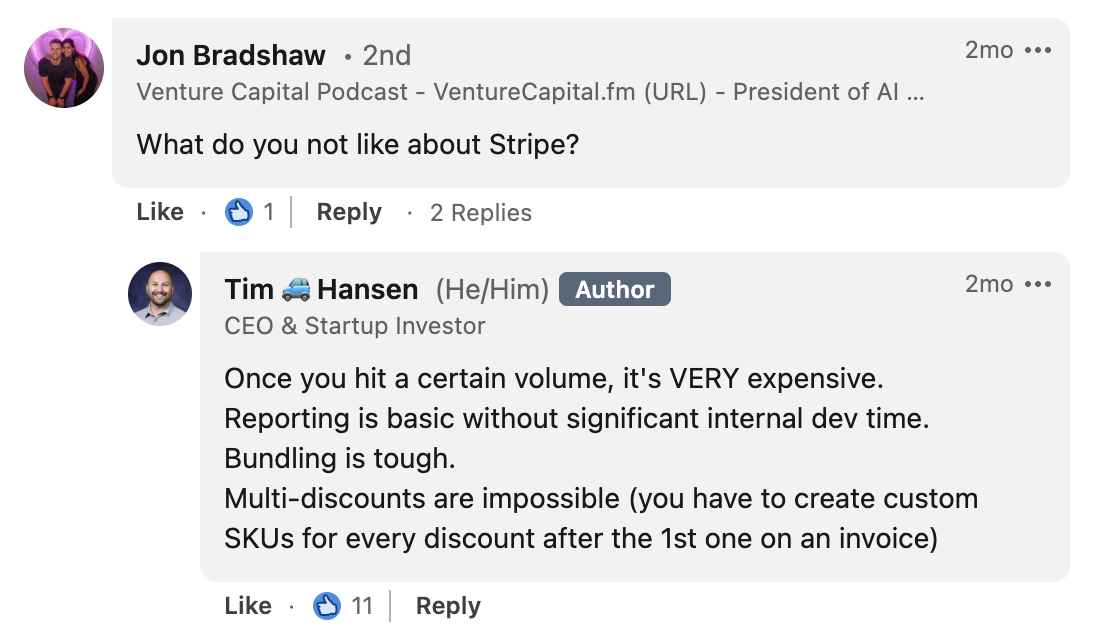

Take Stripe for instance. Here are a couple of shortcomings that you might face with it.

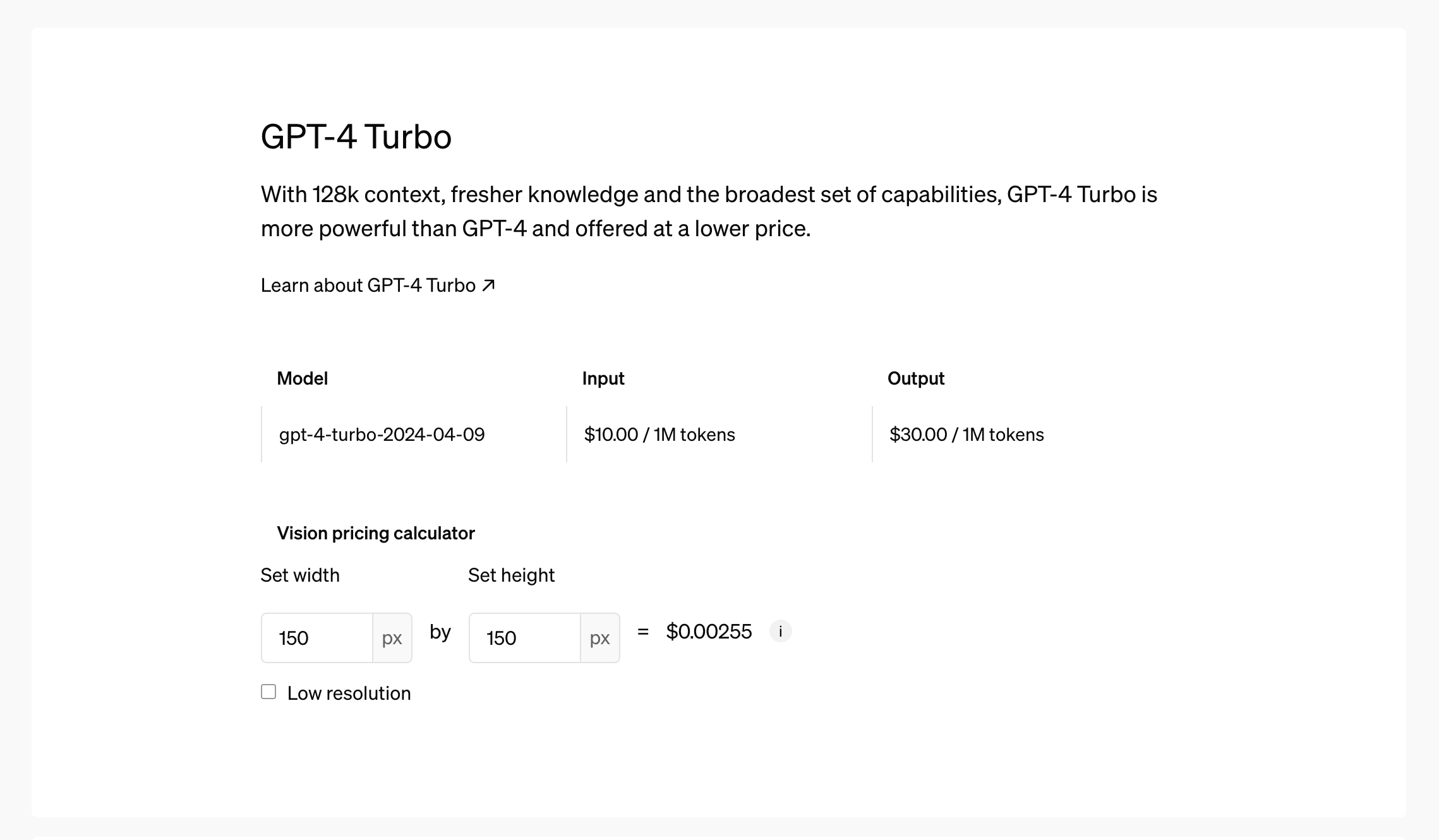

Let us dig a little deeper into the actual cost of using Stripe.

The first question that you need to answer is which Stripe products do you use? Typically it is a combination of Stripe Billing and Stripe Payments to send out a single invoice or recurring invoices. Stripe Billing alone takes 0.5% of your revenue in addition to Stripe Payments which sits at 3-4%. However, if you unwittingly use additional features such as Stripe Checkout, Stripe Payment Links, Stripe Revenue Recognition, Stripe Data Pipeline, Stripe Radar and other products, you could be stacking up to 8-9% of total revenue.

As a more concrete example, say your company is processing $10K in monthly revenue and 50 monthly transactions with the above products enabled. Your net revenue with Stripe with all these features enabled is going to be $9124. Stripe's cut was 8.76% in this scenario.

If part of your revenue was processed by international cards, say 40% of your monthly revenue; Stripe's cut jumps to ~9% of your revenue.

Imagine that number over a year.

Imagine that number 2 years from now, when the volume of your transactions and your monthly revenue both climb up.

You could potentially give this a pass if you had a clear estimate of the costs you'd be incurring. But since you don not know what your revenue will be in the future, you cannot predict how much your billing solution is going to cost you.

The only thing you do know for certain is that it is going to burn a bigger hole in your pocket.

That is just one prong of the cost pile up though. The second prong is Stripe's credits-based onboarding process.

Stripe has a great offering with free credits for founders starting out. At first glance, this seems like a huge bonus. It is only when those credits run out do you realize that you are stuck with an ever-increasing billing cost. You are locked into their ecosystem, so the only control you can exercise is getting an alternative that works in parallel. Unless you are fine with stacking additional percentages for features from Stripe.

A classic lose-lose situation.

The cost pile up is a shortcoming that a lot of people might be aware of. But the next one is something that you do not expect.

It's All Siloed with Unfulfilled Workflows

When running a SaaS business, you would typically start manual billing with a system like Stripe or even just QuickBooks.

Next, you would start experimenting with one go-to-market motion. If that motion is self-serve, you would build an engineering integration with Stripe.

This integration often requires a lot of upfront billing system development before you hit their API and it inherently sets your operational cost model to be commission-based (giving at least 0.5% of the revenue for subscription management on top of 3-4% for payment processing fees).

As your business grows or you iterate through product-market fit, you would start experimenting with other go-to-market mechanisms such as sales-led. As a result, you will spin up another billing system to support contract workflows that Stripe does not support. Sales-led deals are often bigger deals, so using Stripe here would also mean giving away higher revenue cut. However, if login and access to your product is tied to the Stripe-based engineering system, there is no avoiding the 0.5% subscription management fee on your bigger deal.

So, you deploy a CRM like Salesforce or HubSpot with their payments solution or with manual invoicing through QuickBooks. But this system is not perfect either because you will still need to manually follow up for revenue collection if customers do not pay up and you have to pay for yet another SaaS tool for contracts, such as PandaDoc or DocuSign.

Then when it is time to raise funding, you realize you cannot track revenue metrics in one place because they are all siloed in distinct sales motion specific billing platforms.

To find a solution to that problem, you would turn to yet another tool that can help you track the revenue metrics, like ChartMogul or Baremetrics. ChartMogul takes another slice of your revenue while allowing you to track the basic revenue metrics.

Now having added 6-7 tools to your billing stack, you realize you are paying through the nose for a solution where there is no system of record for your collective revenue. So you give up and hire a team to stay on top of this.

And that is not fair to you as a customer. So the obvious next question is...

What Should a Fair and Functional Billing System Look Like

A fair billing system does not take away from your success. It offers fixed, predictable operational costs that work for your business while providing support for your business from day one to IPO regardless of your sales motion.

Here are a few features that we believe make a billing system customer-centric.

Support For Multiple Sales Motions and Modern Pricing Models

Companies often iterate through different sales motions in their early days and most certainly have multiple sales motions when they mature. The billing system needs to be flexible and support iterations in pricing and packaging regardless of your current sales motion. This could be sales-led contracts, self-serve checkout and payment links or even reseller partnerships and parent-billing. Furthermore, several billing solutions have failed to keep up with the needs of the modern SaaS pricing such as usage-based and credits-based billing.

No Organizational Silos

Revenue management typically involve a tangled mess of systems owned by multiple stakeholders such as finance, sales, product and engineering. The billing system needs to be the consolidated source of truth on revenue for your whole company. Otherwise leaders operate on conflicting information and form incoherent goals for different parts of the business. Unfortunately, most billing software is built for a single function of your organization and is held together with loose and inaccurate integrations.

No Lock In

A lot of traditional billing tools lock you into specific payment processing, accounting, tax management solutions. This can make it difficult to support different locale-specific billing. For instance, it prevents you from gaining the advantages of better payment processing rates with other providers. So, you need a tool that provides you the flexibility to opt for other financial software and bring the best tool to the platform.

Fair and Predictable Pricing

If your ARR doubles, the cost of your billing solution should not. Frankly, billing software does not deserve to grow as fast as you. Your need to be able to grow your business fast without worrying about a skyrocketing operational cost. Billing software needs to be available in affordable packages for companies of all sizes and business models. The billing system is a trusted partner for the long haul of your business with predictable pricing.

Unlock a Fair Billing System with Maple

The need of the hour is a revenue-management platform that aligns with your business and organizational growth without putting an unpredictable dent in your revenue.

Maple solves for this need across several organizational stakeholders.

- CEOs and Founders: Maple enables founders and CEOs to keep an accurate pulse on their business with holistic revenue metrics that update as quickly as deals are signed without weeks of reconciliation.

- Sales: Maple enables sales tracking and contract workflows with tight-knit integrations with common CRM tools. As a salesperson, you could track deals end-to-end from contract creation, signature, execution, and payment.

- Finance Ops: Maple can help you automate invoicing, revenue collection, and recovery by bringing these processes together in a single product.

- Product and Engineering: Maple gives product managers full control of pricing and packaging with stable engineering infrastructure for modern pricing models such as usage-based, seat-based and credits-based billing along with entitlements and access management.

Book a demo to learn more about how Maple can streamline and simplify your billing.